BY CYNTHIA MCGRATH | NOVEMBER 12, 2020

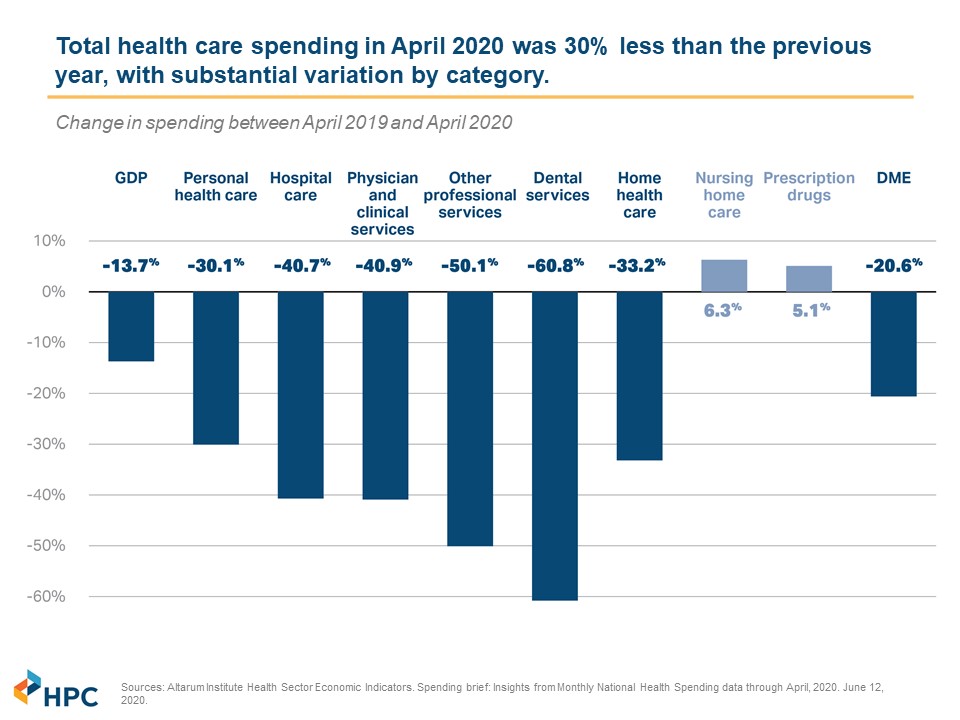

Amidst the pain, anxiety, and budget hits caused by the coronavirus, one bright spot has been reduced healthcare spending. Medical claims dropped precipitously as provider groups closed or limited their practices to ensure capacity for COVID-19 patients. Most elective procedures were canceled or postponed. Patients also stayed away to avoid potential exposure. After a drastic reduction of costs in March, April, and May, claims costs returned to normal levels in June and July, as reported at the New England Employee Benefit Council’s October 15 Healthcare Cost Control Solutions Program.

According to the State’s Division of Insurance, in Massachusetts:

- For August and September, payments came in 5%-20% higher than normal due to catch up demand as well as the increased costs associated with deferred care.

- For October and beyond, the agency projects 10% higher-than-normal payments attributable to this higher demand for services coupled with a push from providers for higher compensation.

The Massachusetts Health Policy Commission, the first-in-the-nation independent state agency that develops policy to reduce health care cost growth and improve the quality of patient care, projects that overall Massachusetts spending for 2020 is on track to come in approximately 10% below 2019 costs. Willis Towers Watson estimates that 2020 costs will be down between 3.3-8.8% in 2020, and will be up between 0.5-5.0% in 2021. They predict total utilization over the two years to be down between 2.8 - 3.8%. HR Consulting firm Mercer estimates that 2020 will end with a 3.3 percent increase over 2019 nationally, and projects a 4.4% increase in 2021, while the National Business Group on Health projects a 5.3% increase. These surveys found that most employers will not shift more healthcare costs onto employees in 2021 amid the pandemic. (Note: edHEALTH member school rate renewals came in lower than the Mercer and National Business Group on Health projections.)

Why Healthcare Cost Increases Could Accelerate

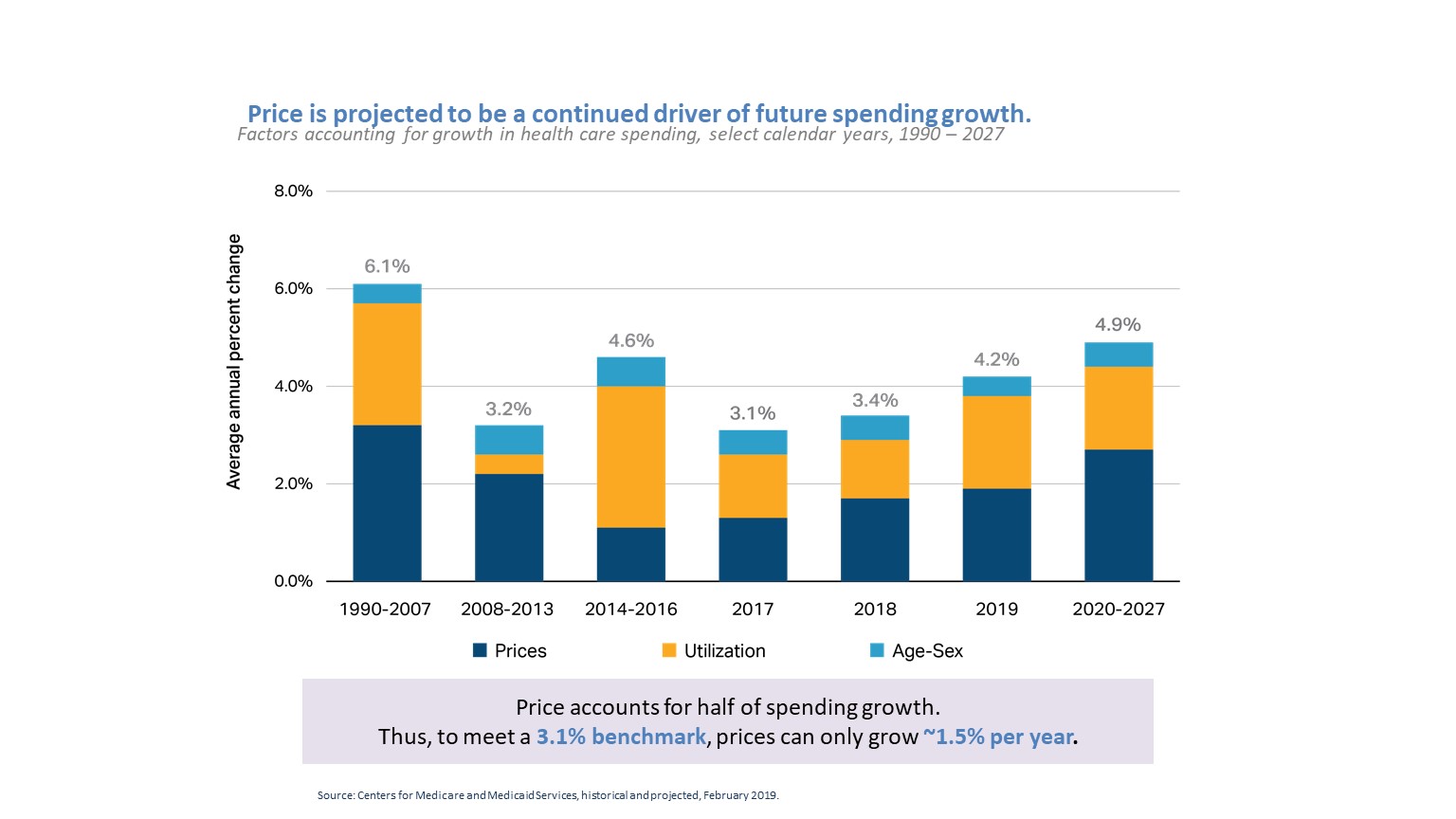

Although this year’s relatively low healthcare spending has been a boon for commercial payers, it’s clear that costs will start to tick up. Some deferred care, such as joint replacements, is not critical. But others, such as cancer treatment, is more urgent. Considerable literature across surgical specialties demonstrates worse patient outcomes and higher costs when essential and urgent treatments aren’t addressed.

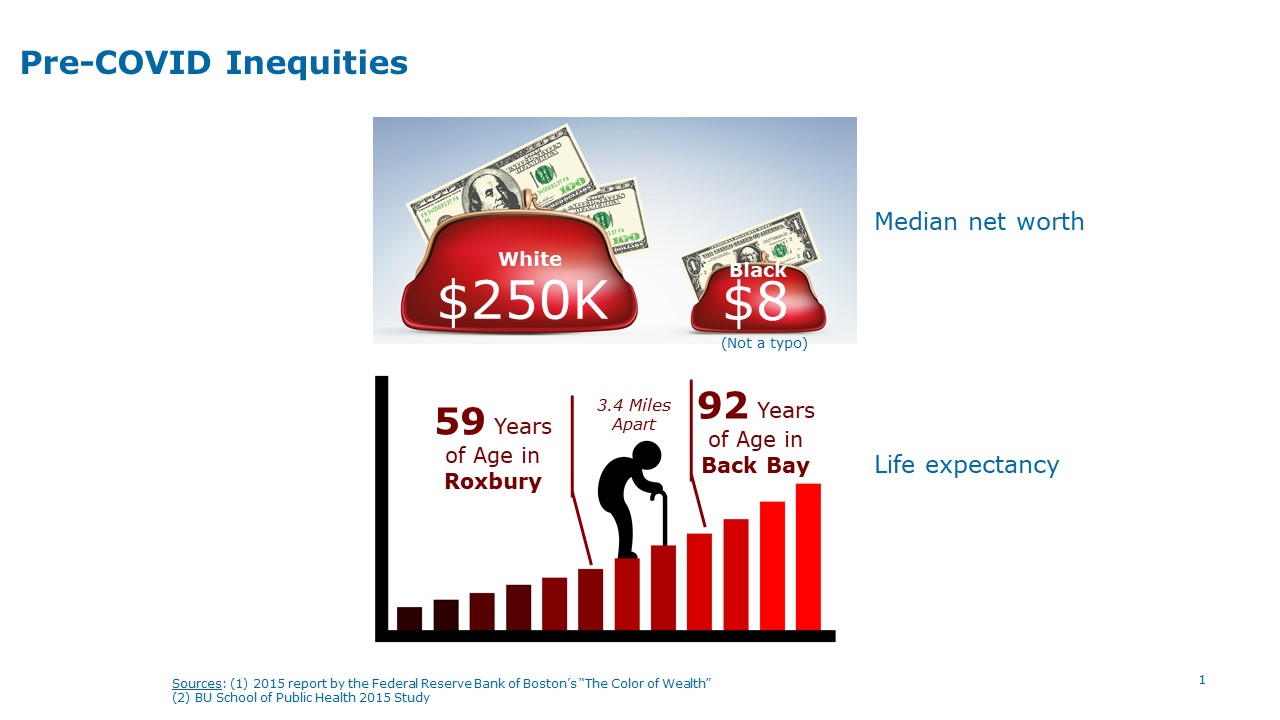

The amount insurers pay hospitals and doctors for their services will be a challenge for payers. Medical prices, and not utilization, are the primary drivers of medical inflation.

The Mass HPC expects providers to seek higher reimbursements from payers to offset the financial hits they have experienced this year. This phenomenon could push up health insurance rates beyond the trends employers have experienced over the last seven years.

“The pandemic has caused unprecedented disruption for the healthcare system – one person’s spending is another person’s revenue,” said Mass Health Policy Commission Executive Director, David Seltz. “This will cause mid- and long-term implications to the affordability of and access to healthcare. Although we are starting to see healthcare utilization return to baseline levels, it has been slow, and the fallout for independent and pediatric practices will be extensive.”

The Health Policy Commission identified three factors that will affect provider reimbursements:

1. Lower Cost Physicians Hit Especially Hard: Primary Care practices, which are crucial in providing coordinated, efficient, and high-value care, have been particularly affected by the pandemic. A June survey of physician practices by the Mass HPC, Massachusetts Chapter of the American College of Physicians, and other academic partners found that primary care practices are struggling financially. Twenty to forty percent of the practices surveyed stated that they were considering consolidating, selling, or closing their practices; independent practices were much more likely to give this response. “There’s an opportunity for payer innovation to incentivize PCPs to manage care and costs more effectively,” said David Seltz.

2. Large Hospital Systems Could Demand Higher Rates: The underlying variation in payment rates to hospitals based on market leverage may widen. Certain hospitals have the market clout to demand and receive higher reimbursement rates. “We can foresee where many of the biggest hospitals seek to recoup some of their financial losses from COVID through negotiating higher payment rates, and we will need to continue monitoring this dynamic,” said David Seltz.

3. An Uptick in Mergers Could Drive Up Costs: “The signs indicate that we can expect more provider consolidation,” said David Seltz. The Kaiser Family Foundation also predicts an uptick in consolidations as some hospitals and physician practices find it difficult to operate independently. If the provider market power coalesces around large delivery systems, health plans will find it increasingly difficult to exert negotiating leverage. “If physicians move into these bigger physician and hospital systems, those physicians will be more likely to refer care in-network to higher priced settings of care,” said David Seltz. “Who your PCP is correlates to what you’re going to spend and which hospitals you go to.”

Planning is Critical - Bold Solutions Can Help Address These Challenges

“It’s been easy to not think about healthcare costs, because they’ve been down,” said Jeff Levin-Scherz, M.D., Managing Director and Co-leader of the North American Health Management Practice at Willis Towers Watson “If we don’t take clear actions on multiple fronts, we will end up with healthcare costs that could go up further.” He identifies three major approaches to reining in costs:

1. Payment Methodologies include shared risk, bundled payments, partial or full capitation. Jeff Levin-Scherz cautions that few payment methodologies hold providers responsible for the cost of care. “We haven’t cracked the nut on moving away from fee-for-service, which still represents approximately 94% of payments,” he says. One approach that’s gaining interest is to reduce out-of-network reimbursements to a percentage of Medicare instead of usual and customary charges. Reference Pricing for elective high-cost procedures could leave patients with large “balance bills.” This approach hasn’t yet been widely adopted in the Northeast.

The June Health Policy Commission/ Massachusetts Chapter of the American College of Physicians survey found that primary care practices report an interest and preference for a partial capitation payment system. “The benefits to providers of this approach are clear as it provides a stable and predictable source of revenue,” said David Seltz.

2. Network approaches include centers of excellence, high-performance/limited network solutions, and on-site clinics. Centers of Excellence encourage employees to receive treatment at selected hospitals known for high-quality specialty care. Eighty-one percent of large employers will have at least one condition-specific Center of Excellence in place next year, according to the Business Group on Health’s 2021 Large Employers’ Health Care Strategy and Plan Design Survey. Bariatric surgery, cancer treatment, and musculoskeletal therapies are most common. Employers are more likely to have mandatory Centers of Excellence programs for bariatric surgery and fertility treatments, according to Jeff Levin-Scherz.

Nearly one-fifth of employers offer high-performance/narrow network solutions in one or more locations, and over 25% have on-site or near-site health center(s), according to Willis Towers Watson. Jeff Levin-Scherz encourages using plan designs that incentivize sicker people to enroll.

3. Telehealth encompasses the use of digital platforms (computers, mobile devices, and telephones) to access health care services remotely and manage an individual’s physical and mental health. The use of telehealth exploded during the spring and, although it leveled off after the initial COVID surge, it’s here to stay, according to Jeff Levin-Scherz. “With telehealth even if the reimbursement is the same as an office visit, payers will save money as doctors use their clinical judgement instead of sending patients for ancillary tests,” he said. Investors are betting that the use of digital health will continue. The number of early-stage digital health companies has exploded. Most employers offer or plan to offer telehealth through their health insurance carrier for simplicity purposes. Using third-party digital, virtual, or coaching solutions, is a growing trend, according to WTW’s 2020 U.S. Healthcare Delivery Survey. Employers that choose to pursue these solutions separate from their health insurance carrier can tailor these programs to their needs. Digital point solutions are particularly suited for patients with mental health and diabetes management needs.

Now is the time to prepare for the financial sustainability of your employee health insurance benefits program. “Although penetration of high-value payment methodologies remains low, employers have many opportunities to increase value through curated networks and through selective use of technology,” says Jeff Levin-Scherz. “Once implemented, be sure to measure your program’s performance, as things don’t always work out as we expect.”

edHEALTH’s Plan Design Committee will evaluate some of these options during 2021.

Cynthia (Cindy) McGrath is edHEALTH's Marketing Communications Strategist.