Learn about edHEALTH's Winter Wellness Challenge and Meet our New Team Member

Here's what you'll read about first newsletter of 2026.Learn about...

Read Full Article

Here's what you'll read about first newsletter of 2026.Learn about...

Read Full Article

Here's what you'll read about in our last newsletter of 2025:Get to know our new edHEALTH Board Chair, John Burke from Boston CollegeGuest feature about the future of primary care Another honor for President and CEO Tracy HassettTrending healthcare-related news stories and moreRead more here.

Read Full Article

Media contact: Lisa BarnsteinedRISK, including edHEALTH, edLIABILITY, and edPROPERTYPhone: 866.692.7473, ext. 703Email: lbarnstein@edrisk.orgedRISK Introduces New Chief Strategy & Membership OfficerOver 25 Years of Experience in Employee Benefits and Consulting with an Expertise in CaptivesDe...

Read Full Article

edHEALTH Announces Appointment of New Board ChairBoston College’s Financial Vice President & Treasurer John Burke Assumes the RoleDecember 11, 2025 (Burlington, VT) – edHEALTH, a medical stop loss captive and healthcare coalition and program of edRISK, announced that Boston College’s Financia...

Read Full Article

Here's what you'll read about in our late fall newsletter:An interview with edHEALTH's new Board Chair, John Burke, Boston College's Financial Vice President & TreasurerGuest spotlight introducing primary care options for better accessInfluential Women in Captives 2025 - featuring our own Tra...

Read Full Article

Here's what you'll read about in our October newsletter:3 tips for engaging with employees about their benefits and more2 Massachusetts member-owner schools recognized for workplace wellness edHEALTH upcoming meetings and fall strategic planning surveyFree downloads to promote diabetes awareness ...

Read Full Article

Here's what you'll read about in our September newsletter:Welcome Assumption UniversityInterview with edHEALTH cofounder on our history and what's ahead 2025 Walking Challenger winner announcededHEALTH upcoming meetings and fall strategic planning Read more here.

Read Full Article

Media contact: Lisa BarnsteinedHEALTHPhone: 866.692.7473, ext. 703Email: lbarnstein@edrisk.orgedHEALTH Welcomes New Member-Owner School Effective September 1, 2025Now with 29 schools, including Assumption UniversitySeptember 8, 2025 (Burlington, VT) – edHEALTH, a collaborative of educational inst...

Read Full Article

We are honored to share that our phenomenal President and CEO, A. Tracy Hassett, once again received Captive Review's leading global captive owner. Earning a spot on this list recognizes Tracy's forward-thinking vision in uncovering opportunities to help educational institutions control insurance...

Read Full Article

There's so much to catch up on in our June newsletter:edRISK 2024 annual reportLearnings from edHEALTH's annual member meetingIn the news section, with timely industry-related articlesAccess this information and more edHEALTH member-owner updates here.

Read Full Article

In our May update, you will discover:Health and wellness tips for your campus or organization Summer safety downloads to shareedHEALTH upcoming annual member meeting and walking challengeRead all about these three tips here, plus more edHEALTH member-owner updates.

Read Full Article

In our April newsletter, we highlight:Understanding Cell and Gene Therapy and Its Impact* Easy and free resources to support Mental Health Awareness Month Upcoming edHEALTH Walking ChallengeAnd MoreRead edHEALTH's April 2025 edition here. *Courtesy of the National Alliance of Healthcare Purchase...

Read Full Article

The following year-in-review message was shared with member-owners and business partners on March 24, 2025.Dear Member-Owners and Business Partners,This year, we mark a new milestone at our member-owned coalition – recognizing the productive and successful year of our captive edRISK and its three...

Read Full Article

In our March update, we offer readers:Simple tips for promoting the many benefits available at your institutions all year long (no need to wait until open enrollment time)Free Resources for April's Autism Acceptance MonthUpcoming member meetingsedHEALTH planning for 2026 benefits And MoreRead the...

Read Full Article

In this month's newsletter, we feature a guest spotlight highlighting voluntary benefits, which can be a valuable tool for your competitive benefits package. You'll also discover:Wellness resource templates for March's MS Awareness Month and Sleep WeekMember-owner meetings dates Trending topics, ...

Read Full Article

In our first newsletter of 2025, this member-owner-focused edition includes:Introduction of our winter school-wide challenge Resources for February's Heart Health Awareness MonthUpcoming member-owner meetingsTrending topicsYou can read it all here.

Read Full Article

In our November newsletter, you'll read about:Wellness platform available to all edHEALTH schools Influenza Awareness Week, including a free downloadUpcoming member-owner meetings, including the 2025 annual meetingTrending topicsYou can read it all here.

Read Full Article

In our October newsletter, you'll read about:Insights into creating a productive HR team and wellness programResources to promote November's Diabetes Awareness MonthedRISK's new employee Stephanie PashaThe creation of edRISK as featured in Captive ReviewUpcoming member-owner meetingsAnd moreYou c...

Read Full Article

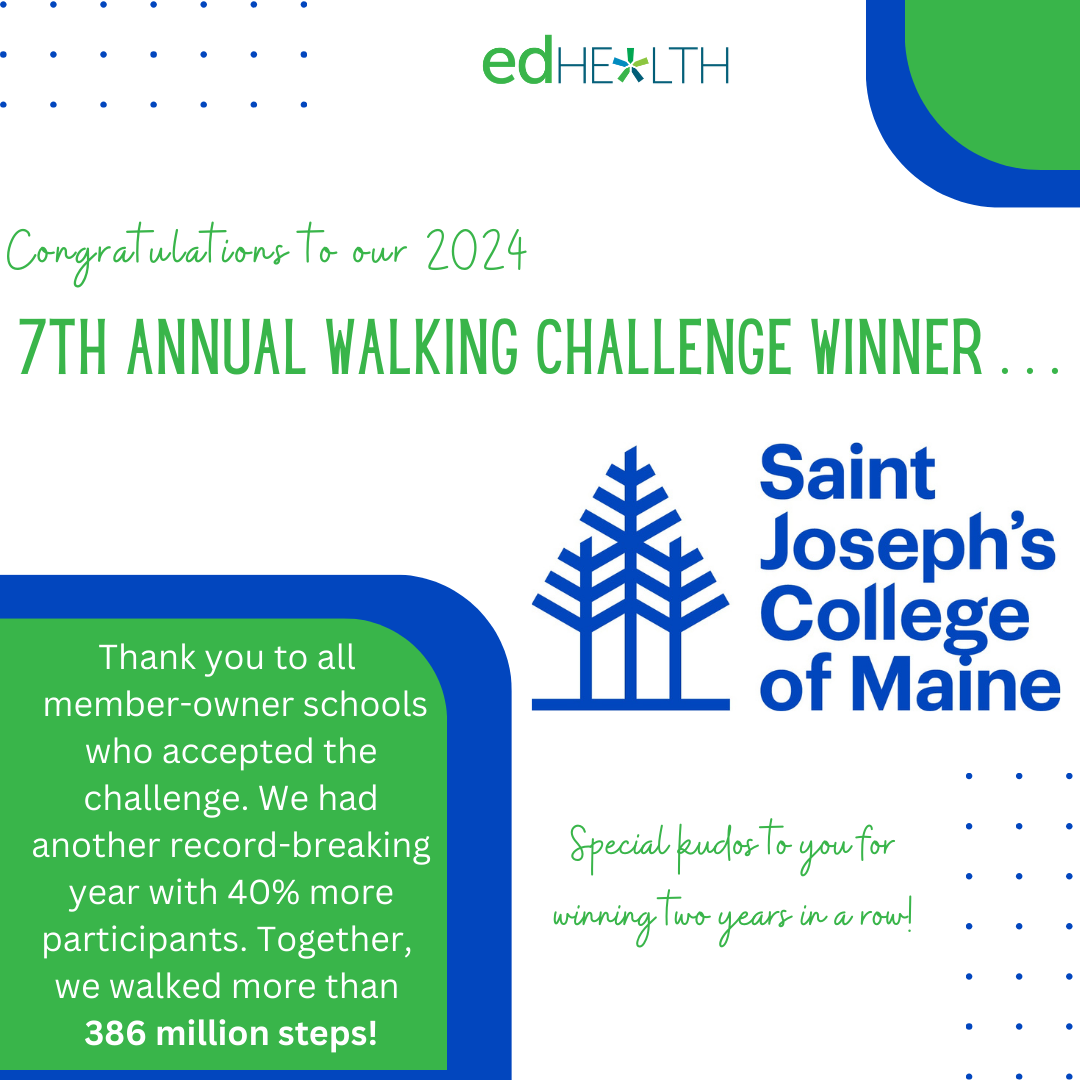

Check out our September newsletter! Inside you'll discover:Interview with Wellesley College's AVP and Controller 2024 edHEALTH Walking Challenge winnerResources for October's Breast Cancer Awareness MonthedRISK is Captive Review's Cell Captive Initiative of the Year New reports and templates avai...

Read Full Article

We always appreciate the opportunity to talk with the Captive Review team. Thank you! In their most recent feature, A. Tracy Hassett and David White, CPA, ACI, discuss the creation of edRISK and our two new programs or cells, edLIABILITY and edPROPERTY, all of which stem from the 11-year-old succ...

Read Full Article

edRISK, which includes edHEALTH, edLIABILITY, and edPROPERTY, is currently hiring for a role that combines the functions of a corporate governance secretary, office manager, and executive assistant into one extraordinary new position. Read the following job description, and if interested, please ...

Read Full Article

Thank you, Captive Review, for recognizing edRISK, which includes edHEALTH, and its two new cells, edLIABILITY and edPROPERTY. We appreciate your support in all we do. For a full list of this year's Captive Review award winners, visit captivereview.com.

Read Full Article

Congratulations, Saint Joseph's College of Maine!Thanks to the 21 schools and the edHEALTH team that participated in our summer walking challenge. We had 40% more participants than last year's record. This year, we also added a week to include the July 4 holiday.Together, we walked more than 38...

Read Full Article

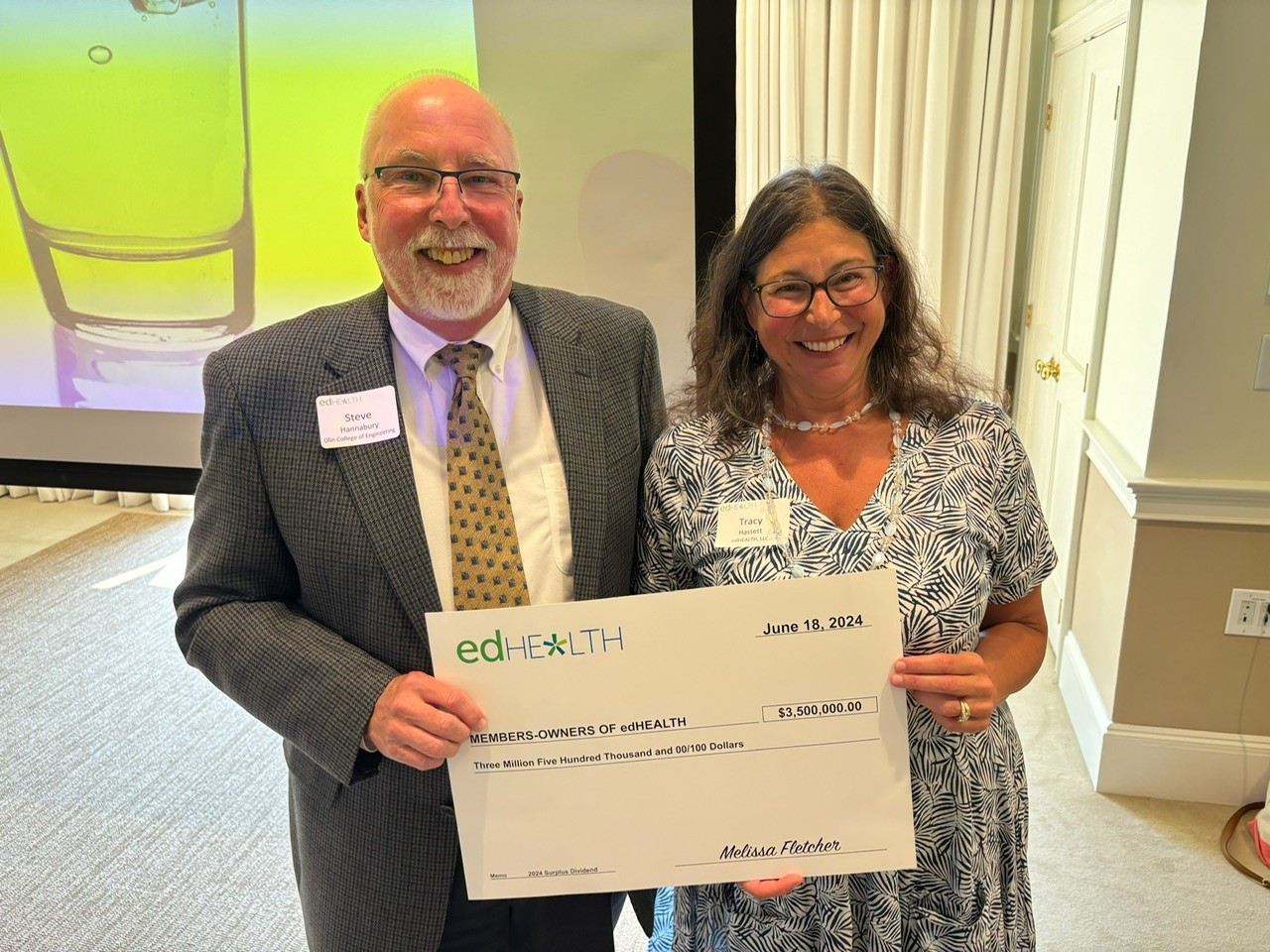

June is always a busy time for edHEALTH. Read our summer newsletter to learn about:$3.5 million dollars returned to member-owner schoolsedHEALTH's 2023 annual report publishededHEALTH and Wellesley College present at NACUBO's annual meeting The Lawrenceville School's Ben Hammond joins edHEALTH bo...

Read Full Article

Today, June 24, 2024, The Boston Consortium for Higher Education released this press release about edRISK, which includes edHEALTH and two new captive insurance cells or programs launched on June 1, edLIABILITY and edPROPERTY.FOR IMMEDIATE RELEASEThe Boston Consortium for Higher Education, Inc., ...

Read Full Article

This year's meeting attendees were the first to receive our 2023 annual report. In it, you can read about our strength as a coalition dedicated to helping educational institutions save money on their employees' health insurance. You can read our report here.

Read Full Article

edHEALTH Adds New Board Member from a Secondary School Member-OwnerBen Hammond, Chief Financial & Administrative Officer from The Lawrenceville School JoinsFOR IMMEDIATE RELEASE: June 11, 2024Northbridge, MA (June 11, 2024) edHEALTH announced today that Ben Hammond, the Chief Financial and Ad...

Read Full Article

Thank you, Global Captive Podcast (GCP), for inviting Tracy Hassett, President and CEO of edRISK, which includes edHEALTH, edLIABILITY, and edPROPERTY, to be interviewed for a GCP Short about the origin and launch of our new cell programs on June 1st. She is joined by Prabal Lakhanpal, Senior Vic...

Read Full Article

FOR IMMEDIATE RELEASE: June 3, 2024Media contact: Lisa BarnsteinedHEALTHPhone: 866.692.7473, ext. 703Email: lbarnstein@edrisk.orgJune 3, 2024 (Northbridge, MA) – edHEALTH, a coalition of educational institutions providing greater healthcare-related savings and services through group purchasing, o...

Read Full Article

In this month's newsletter, you'll discover:Tips to inspire health and wellness from an edHEALTH schoolSelf-serve health and wellness digital downloadsGearing up for dHEALTH's 7th annual walking challengeA top captive ownerUpcoming member-owner meetingsAnd moreYou can read it all here.

Read Full Article

edHEALTH and edRISK's President and CEO Tracy Hassett was just named one of Captive Review's Top 20 captive owners for 2024. She, in particular, was commended for her efforts in creating edRISK to increase savings opportunities in other lines of insurance for educational institutions. You can rea...

Read Full Article

This April's newsletter has so much information to share, including:Overview and update on biosimilar adoptionApril member-owner Rx Symposium and other member meetingsedHEALTH member-only listservResources for May's Mental Health Awareness MonthAnd moreYou can read it all here.

Read Full Article

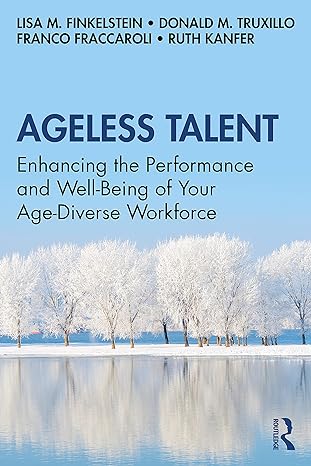

Check out our March newsletter! Inside you'll discover:Tips for your workplace from our Ageless Talent: Debunking Myths Webinar with Dr. Lisa FinkelsteinAutism Awareness download to share this April edHEALTH and Tracy Hassett in the newsOur newest employee Kelly DrakeTake 5 with our Vice Presiden...

Read Full Article

Thank you, Captive Insurance Times, for talking with edHEALTH President and CEO Tracy Hassett about how edHEALTH brings together educational institutions to help bend the trend in rising employee healthcare costs. This article highlights how our member-owner schools are better together. You can r...

Read Full Article

The following year-in review message was shared with member-owners and business partners at the end of February 2024.Dear Member-Owners of edHEALTH,You all know by now that I am a direct person. I am also inspired by clearly stated thoughts and reflections. In the words of author Bryant H. McGill...

Read Full Article

Check out our February newsletter! Inside you'll read about:Upcoming Multi-Generations in the Workplace Webinar on February 28Guest Spotlight: A Unique Perspective on Weight-Loss Medication CoverageUpcoming member-owner meetings A new member-owner employee communicationsOur President and CEO's an...

Read Full Article

edHEALTH and edRISK's President and CEO Tracy Hassett and Chief Financial and Operating Officer David White were recently interviewed about what's next for edHEALTH. You can read their interview here: https://captiveintelligence.io/edrisk-to-launch-liability-and-property-cells/

Read Full Article

In the first newsletter of 2024, you'll learn about:Our February 28 Thought Leadership SeriesWellness in the New Year: 5 Simple TipsedHEALTH's 2 New Schools New Member-Owner TemplatesOur Open PositionAnd MoreRead the January 2024 edition here.

Read Full Article

Highly respected professor and author Dr. Lisa Finkelstein of Northern Illinois University will be busting some pervasive myths about stigmas and generations in the workplace while providing some evidence-based best practices for enhancing the performance and well-being of our age-diverse workfor...

Read Full Article

edHEALTH Welcomes Two New Member-Owner Schools in 2024Now with 27 schools, including Husson University and The Lawrenceville SchoolJanuary 5, 2024 (Northbridge, MA) – edHEALTH, a consortium of educational institutions providing greater health-care-related savings and services through group purcha...

Read Full Article

edHEALTH helps educational institutions save money on their employee healthcare costs, facilitates collaboration between Human Resources and Finance, and uncovers innovative opportunities to improve the health and well-being of faculty, staff, and their families. edHEALTH is a member-owned organi...

Read Full Article

In our November 2023 newsletter, you'll read about:3 new program offerings to member-owner schoolsDiabetes Awareness MonthWhat's new in the member portalOur new hire and open Benefits Analyst/Membership Support positionRead here now.

Read Full Article

Thank you, Captive International and Captive Intelligence, for featuring David White joining edHEALTH and edRISK effective December 1, 2023. You can read these announcements here:Captive Intelligence Captive International

Read Full Article

November 15, 2023 – edRISK and edHEALTH, a consortium of educational institutions providing greater health-care-related savings and services through group purchasing, ownership, and data-driven programs, announced today that David White, CPA, ACI, ARM, will join the organization effective Decembe...

Read Full Article

In our October 2023 newsletter, you'll read about:Creating inclusive employee benefits: A blueprint for diversity, equity, and inclusionedHEALTH member-owner school receiving 2 wellness awards this fallAttending our new edHEALTH member-owner 101 sessionsTrending industry topicsRead here.Photo by ...

Read Full Article

This fall, our own Tracy Hassett was endorsed for and reappointed as Board Chair for The Vermont Captive Insurance Association (VCIA) for a second term. Continuing in this role enables Tracy to see through the strategic planning now underway to enhance VCIA's value. You can read more here.

Read Full Article

edHEALTH provides share-it employee engagement communications to help member school employees navigate and maximize their healthcare benefits. Members can find resources from our TPAS and more in the edHEALTH Portal. Templates in the portal include behavioral health resources, pharmacy benefits, ...

Read Full Article

Read edHEALTH's September 2023 newsletter to discover: How to optimize success during your fall annual open enrollmentWhich school won edHEALTH's 2023 Walking Challenge What's inside our member portalTwo news articles Trending news worth a readAnd moreRead here.

Read Full Article

Check out edHEALTH's June 2023 newsletter, which highlights: Changing Times in Human Resources: Leaders Share How They’re Building a Strong Recruitment and Retention Strategy Celebrating 10 years and looking ahead at edHEALTH's annual member-owner meeting Double the participation in our annual ...

Read Full Article

In commemoration of edHEALTH's ten-year anniversary, we published our first annual report. In it, we highlight how we have saved member-owner schools more than $155 million since inception and the many additional services available to member-owner schools. You will also learn a bit about edHEALTH...

Read Full Article

Check out edHEALTH's May 2023 newsletter, featuring: Understanding growing behavioral health needs &how to support a healthier workplaceedHEALTH featured in Risk & Insurance magazineedHEALTH Walking Challenge is coming soon What's happening in industry news And moreRead here.Photo by An...

Read Full Article

This spring, edHEALTH President and CEO Tracy Hassett had the honor of being interviewed by Risk & Insurance magazine by Emma Brenner. The May/June 2023 feature highlights "how higher education institutions can turn to captives as an effective and affordable solution to serve their insurance...

Read Full Article

Read our April newsletter for valuable insights and edHEALTH member-owner updates:The Intersection of Employee Wellness & Pharmacy Costs (Guest Spotlight)April's Autism Awareness and How to Learn MoreMay 11th's Thought Leadership Series Featuring Jill Borrelli, LICSW, Vice President of Behavi...

Read Full Article

Congratulations to our own President and CEO A. Tracy Hassett. She is named one of Captive Review's Top 20 Captive Owners 2023. Tracy received recognition for her commitment to edHEALTH and her work as the current board chair of the Vermont Captive Insurance Association. You can read more here:ht...

Read Full Article

Check out edHEALTH's February 2023 newsletter, featuring: Answers to what Benefit Advisors askInsights from our Captive ManagerMember-owner calendar corner Savings tip for select behavioral health providersWhat's happening in industry newsRead here.

Read Full Article

What you'll read about in edHEALTH's January 2023 newsletter:Rising costs of Rx: 3 ways to maximize savings opportunities with your employeesAnswers to commonly asked questions from Human Resources Professionals about edHEALTH2023 edHEALTH President's messageNew member-owner tools for employeesed...

Read Full Article

Dear Colleagues,"Coming together is a beginning; keeping together is progress; working together is success."These words, attributed to Henry Ford, founder of Ford Motor Company, describe edHEALTH perfectly. As edHEALTH wraps up our ninth year, we continue to work together to uncover innovative op...

Read Full Article

(December 12, 2022) - edHEALTH announced today three new members were elected to the Educators Health LLC Board of Managers and the Educators Health Insurance Exchange Subscribers Advisory Committee. Joining the boards are Kimberly Aliotte, Senior Advisor for Human Resources and Talent at KIPP Ma...

Read Full Article

Check out edHEALTH's November 2022 newsletter, which features:What you can do to inform and support employees about flu seasonAnswers to commonly asked questions about the finance perspective of edHEALTHTrending health-care related articlesDownloadable content to spread the word about flu protect...

Read Full Article

Inside our October 2022 newsletter, you'll read about:Our November 2 virtual and free Thought Leadership Series with Human Resources leader Megan NailThe Cost of Musculoskeletal Conditions is One of Today's Leading Cost Drivers (guest article)Tracy Hassett's new role on VCIA boardTimely healthcar...

Read Full Article

Great news for the Vermont Captive Insurance Association (VCIA), as they've selected edHEALTH President & CEO to be their new Board Chair. The VCIA, one of the largest associations for captives worldwide, provides education and legislative advocacy. Tracy is excited to engage with all captive...

Read Full Article

Photo by Yan KrukovSince the pandemic, most employers have seen significant shifts in how to manage open enrollment periods. From big fairs onsite to virtual meetings, and emails sent with pdfs, intranet links, or pre-recorded presentations, there are many variations. This year, more organization...

Read Full Article

Hear from edHEALTH President and CEO Tracy Hassett as she was interviewed with Spring Consulting’s Managing Partner Karin Landry in a recent GCP Short. In this 15-minute episode, you can learn more about edHEALTH, how it brings together educational institutions to pool purchasing power and save m...

Read Full Article

Want to learn more about Captive Insurance? Join edHEALTH's President & CEO, Tracy Hassett, along with other industry leaders, talks about medical stop loss on Thursday, August 11th at the 2022 VCIA Annual Conference in Vermont. If not at the conference, visit our website again soon for a lin...

Read Full Article

It’s a question that America's Health Insurance Plans (AHIP) asked in a recent survey that the Locust Street Group completed on behalf of AHIP Coverage@Work.According to the study: “The vast majority (75%) report that their coverage was important to maintaining the health and financial security o...

Read Full Article

In our summer newsletter, you'll findAn overview of the value and cost of cell and gene therapyShare-it downloads for promoting summer safety among employees, including telehealth while on vacationan edHEALTH annual meeting recap plus timely member-owner information Our member-owner schools also ...

Read Full Article

Understanding the value and costs of cell and gene therapyInnovation in health care is constant and is marked often by significant breakthrough treatments and cures. Not too long ago, we thought of the idea of altering a gene to cure or treat a disease to be science fiction. But, today, that conc...

Read Full Article

In our most recent newsletter, you'll learn:Why workplaces should support employees with mental health awareness year-roundHow telehealth continues to be an important resource when it comes to behavioral health servicesTips and resources to help reduce stress in the workplaceOur member-owner scho...

Read Full Article

Read about: The emergence of biosimilars for curbing specialty costsGearing up for edHEALTH's 5th annual Walking ChallengeNews and tips for spring health and wellbeingSurvey results from last monthRead the April 2022 digital edition of our newsletterSubscribe to newsletterPhoto by Marcelo Leal

Read Full Article

Last month we highlighted how both cost and utilization are increasing when it comes to prescription drugs. Much of the increase is due to the rise in specialty medications. This trend is national, across all industries, and continues to be of great concern. The rising costs of medications result...

Read Full Article

The Association of Independent Colleges and Universities in Massachusetts (AICU MASS) offered edHEALTH the opportunity to discuss one of the biggest trends facing schools today – healthcare and rising costs – in their most recent member newsletter. You can read our insights in their Hub of Higher...

Read Full Article

Learn about:The big picture when it comes to medication breakthroughs, their costs, and how we all play a role in trying to control costsedHEALTH's 3 new board members When edHEALTH's 2022 Walking Challenge takes placeThe newest team member at edHEALTHHow readers can help us improve by sharing th...

Read Full Article

Healthcare experts, employers, and consumers alike recognize the significance prescription drugs have in today’s world. Thanks to clinical innovations in the pharmaceutical world, especially when it comes to specialty medications, more people can better manage their health conditions with new med...

Read Full Article

(March 22, 2022) - edHEALTH announced today three new members were elected to the edHEALTH LLC Board of Managers and the edHEALTH Insurance Exchange (edHEALTH Captive) Subscribers Advisory Committee. Joining the boards are: Marymichele Delaney, Chief Human Resources Officer at College of the Holy...

Read Full Article

Dear Colleagues,Strength. Resilience. Support. Collaboration. Opportunity. Hope. Trust. These are just a few of the words that come to my mind as we look ahead to 2022. We are still facing incredibly challenging times with the ongoing pandemic and the realities of the uncertainties ahead....

Read Full Article

BY CYNTHIA MCGRATH | November 15, 2021Primary care practices, which are crucial in providing coordinated, efficient, and high-value care, were severely impacted by the pandemic. Primary Care Providers (PCPs) closed or limited their practices to ensure capacity for COVID-19 patients and patients s...

Read Full Article

BY CYNTHIA MCGRATH | December 16, 2021Unstoppable healthcare costs are eating up resources that companies and governments could better use to advance other important priorities. Healthcare rate increases will jump around 5% in 2021, according to a recent SHRM article. Not only does this hamper em...

Read Full Article

Educators Health Exchange President, Tracy Hassett, was selected Vice Chair by the Board of the Vermont Captive Insurance Association (VCIA). VCIA is the largest trade association for the captive industry and provides educational opportunities and legislative advocacy. As reported in October, Tra...

Read Full Article

Point32Health, the combined Tufts Health Plan and Harvard Pilgrim Health Care organization, selected UnitedHealthcare as its national network provider effective January 1, 2024. UnitedHealthcare is already the national provider for Harvard Pilgrim Health Care members, so there are no changes for ...

Read Full Article

BY CYNTHIA MCGRATH | October 21, 2021The Mental Health Crisis and Its Effects on Employees and EmployersThe pandemic has upended lives and led to increased rates of stress, anxiety, depression, and substance abuse. Seventy-six percent of U.S. employees surveyed report at least one symptom of a me...

Read Full Article

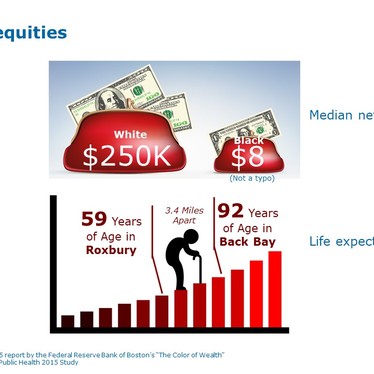

BY CYNTHIA MCGRATH | August 9, 2021Racial justice protests and the disproportionate impact of COVID-19 on communities of color have shone a light on the need for organizations to improve diversity, equity, and inclusion (DE&I). The higher education industry has taken a leading role in tacklin...

Read Full Article

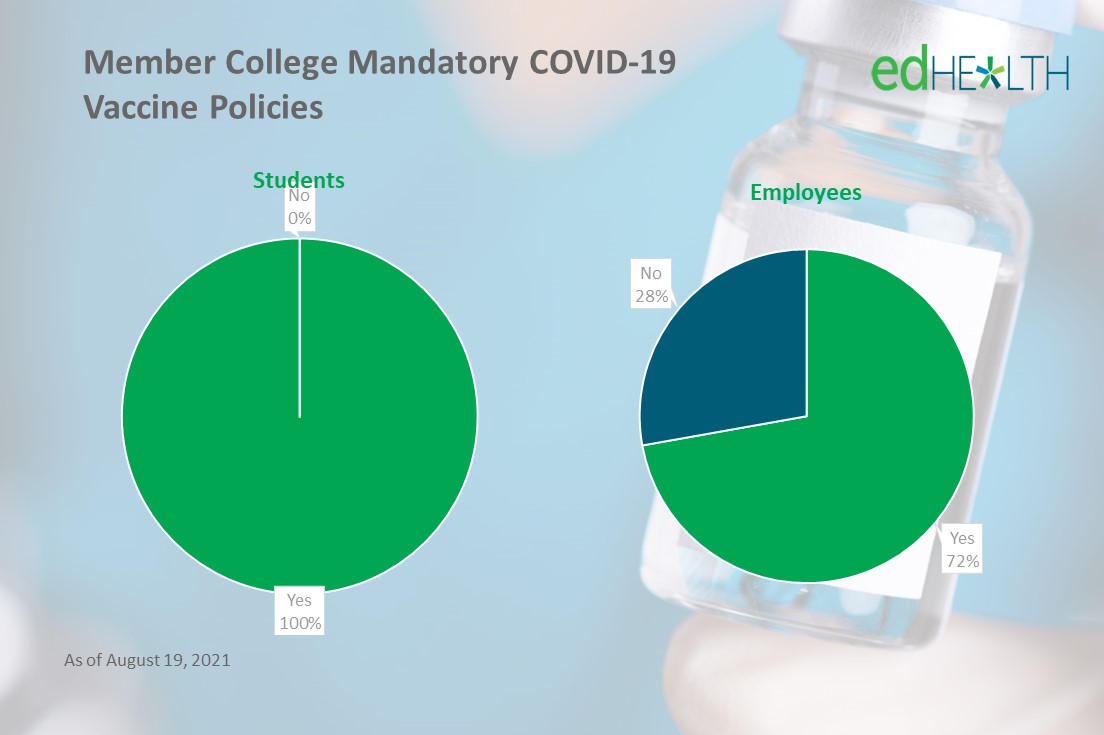

BY CYNTHIA MCGRATH | UPDATED AUGUST 10, 2021Colleges and universities should require COVID-19 vaccines for all students who plan to attend in-person classes, according to an April 14 New York Times editorial. The authors posit that vaccine mandates are the fastest way to return to normalcy by ach...

Read Full Article

From the May 20, 2021 issue of Captive ReviewCaptive Review recognized Educators Health Exchange (edHEALTH) President and CEO, Tracy Hassett, as a top 10 Power Captive Owner. The Captive Review Power 50 is an annual list of the most influential captive insurance professionals from the last year. ...

Read Full Article

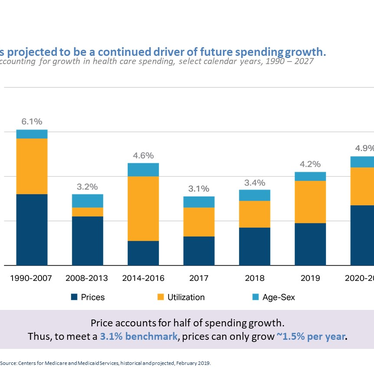

BY CYNTHIA MCGRATH | MARCH 18, 2021The U.S. is spending nearly 20% of its Gross Domestic Product on healthcare services, which crowds out other needed products and services. Most other countries limit spending by imposing tight budget constraints on spending. Why are healthcare cost rising so qui...

Read Full Article

Reproduced from the special edition of the Chronicle of Higher Education: Financial Strategies for a Crisis and BeyondBy ALEXANDER C. KAFKA | December 2020As with the upstate New York consortia, New England has its own consortia within consortia and overlapping groups. For instance, a major drive...

Read Full Article

Reproduced from the December 2020 issue of the Risk Retention ReporterDownload the December 2020 edHEALTH Risk Retention Reporter Reprint.pdfBy CYNTHIA MCGRATH | December 24, 2020As the coronavirus pandemic has decimated large swaths of the economy, higher education has been hit particularly hard...

Read Full Article

BY CYNTHIA MCGRATH | DECEMBER 15, 2020It’s a challenging, yet critical, time to increase your employee engagement efforts. The education sector is facing significant challenges due to enrollment drops and the costs of COVID prevention and monitoring. The usual ways of communicating – in-person me...

Read Full Article

BY CYNTHIA MCGRATH | OCTOBER 7, 2020The Trends and Why They Could Get WorseThe pandemic has upended everyone’s life and the strains are showing in the escalating rates of anxiety and depression. In March, 32% of U.S. adults reported that their mental health had been negatively affected due to wor...

Read Full Article

BY CYNTHIA MCGRATH | SEPTEMBER 14, 2021To borrow from actor John Krasinski, we can all use some good news – especially in healthcare. One of our member school employees has a story that makes us smile. Are you familiar with a mobile hospital, also known as a mobile ER department and mobile urgent...

Read Full Article

Published in the April 1, 2020 issue of the New England Journal of Higher Education.By CYNTHIA McGRATH | April 1, 2020The COVID-19 pandemic is top of mind for everyone. There’s no aspect of our lives that’s been untouched. For colleges and universities, the novel coronavirus crisis has caused a m...

Read Full Article

BY CYNTHIA MCGRATH | FEBRUARY 18, 2020Tackling rising costs and gaps in healthcare quality remains a challenge. One of the hottest trends over the last few years to address these needs – high-deductible plans and consumerism – is on the decline. A January 2020 report by Lively, a Health Savings A...

Read Full Article

By CYNTHIA MCGRATH | February 4, 2019How do we go about improving care for our employees while reducing costs? That’s the conundrum facing most employer healthcare purchasers. According to Workpartners, edHEALTH’s data warehouse, 5% of our insureds represent over 50% of our claim costs. Our Board...

Read Full Article

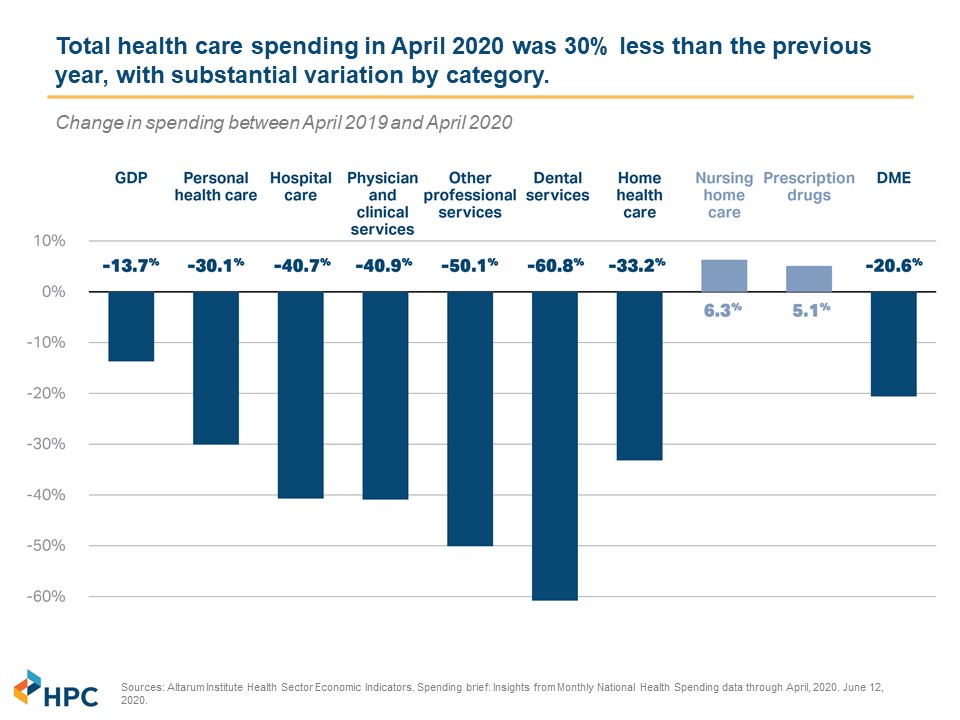

BY CYNTHIA MCGRATH | NOVEMBER 12, 2020Amidst the pain, anxiety, and budget hits caused by the coronavirus, one bright spot has been reduced healthcare spending. Medical claims dropped precipitously as provider groups closed or limited their practices to ensure capacity for COVID-19 patients. Most...

Read Full Article

866.692.7473

info@educatorshealth.org